Click Here to Download 'The Present Truth' Articles in PDF Format Now

Rulers of Evil - Useful Knowledge About Governing Bodies, by F-Tupper-Saussy

The Miracle On Main Street, by F-Tupper-Saussy

Sovereign to Serf (Government by the Treachery and Deception of WORDS), by Roger S. Sayles

IT IS ALL ABOUT THE MONEY

"For wisdom is a defence, and money is a defence: but the excellency of knowledge is, that wisdom giveth life to them that have it." (Ecclesiastes 7:12 KJV)

1 Timothy 1:17 (KJV):

"Now unto the King eternal, immortal, invisible, the only wise God, be honour and glory for ever and ever. Amen."Johann Wolfgang von Goethe stated it well, - "There are none so helplessly enslaved as those who falsely believethey are free."

Discover the Hidden Truths of America's Financial System

Uncover the startling revelations behind America's banking system on this page. This eye-opening work delves into the secretive practices of the central banking system and its far-reaching impact on our society. Discover why the media, politicians, and even the church may not be telling you the whole truth.

- Learn How Money Controls Everything: Understand how money influences the media, politicians, judges, and even the church, and how this control affects every aspect of our lives.

- Expose the Hidden Agendas: Unveil the hidden agreements and secrets that keep the banking system's true operations out of the public eye.

- Empower Yourself with Knowledge: Equip yourself with the insights and strategies to use the banking system to your advantage and reclaim your financial freedom (or at least you will know the truth: Knowledge is Power.).

- Understand the Connection to Biblical Prophecy: Explore the ties between modern banking practices and biblical prophecies, and what this means for the future.

Don't miss this chance to gain a deep understanding of the real issues plaguing America and countries worldwide with central banks. Click the link below to read "America's Hope" and join the fight for financial transparency and justice.

In economic terms, "fiat currency" refers to money that has value because a government declares it legal (not lawful) tender, not because it is backed by a physical commodity like gold.

In this instance, "by decree" means that something is established or made official by an authoritative order or law, rather than by inherent value or tangible backing. When applied to "fiat currency," it means the currency has value because the government officially declares it as legal tender. The value doesn't come from the material it's made of (like gold or silver) but from the government's mandate that it must be accepted for transactions. Essentially, the currency's worth is based on trust in the government's authority and economic system.

Ancient history records leaders like Hannibal and Caesar fighting against the bankers. No church website would be complete without acknowledging the Bible's condemnation of today's banking system. Moses gave the bookkeeping entries of today's bankers and condemned it. History acknowledges Moses as the first lawgiver prohibiting today's banking system. The Apostle Paul called it a swindle. The Apostle Paul insisted anyone involved in this practice be thrown out of the church. President Andrew Jackson fought the moneychangers and won his battle. He read and believed the Bible. President Jackson followed the Bible's condemnation of today's banking system. President Jackson declared that, "the Bible is the rock on which our Republic rests. I thank the President and Congress for making PL 97-280, 96 Stat 1211 law proclaiming the Bible to be the 'WORD OF GOD.' This law allows Americans to use their religious beliefs in condemning the banking practice.Historical Condemnation of the Banking System

Learn More and Read the Full Books by Tom Schauf

Read America's Hope: To Cancel Bank Loans Without Going to Court (pdf)

Read America's Hope: To Cancel Bank Loans Without Going to Court (text)

Read Top Secret Banker's Manual by Tom Schauf (pdf)

Read Top Secret Banker's Manual by Tom Schauf (text)

Read The Borrower Should Repay the Lender by Tom Schauf (pdf)

Read The Borrower Should Repay the Lender by Tom Schauf (text)

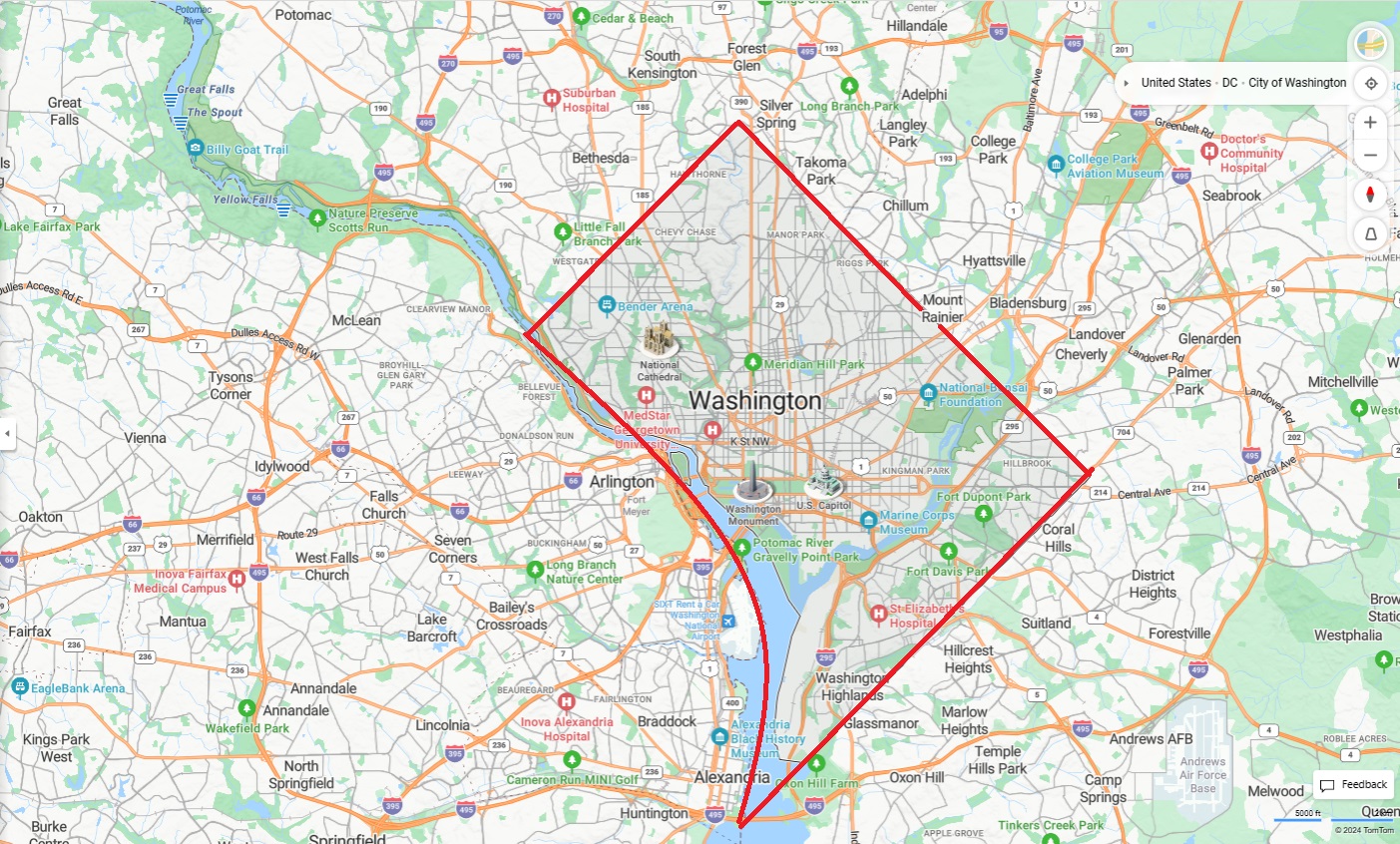

Nestled in Washington D.C.'s ten square mile history is a surprising connection to a little-known place: Rome, Maryland. This discovery unveils a unique glimpse into America's past and marks the beginning of what is now known as the FEDERAL CORPORATION called "UNITED STATES," established on June 5, 1663. Just three years later, in 1666, the Cestui Que Vie Act was formed and has never been repealed. This act signifies the papacy's influence in creating this new FEDERAL CORPORATE "UNITED STATES." The "UNITED STATES," also known as the "DISTRICT OF COLUMBIA" or "WASHINGTON, DC," has a hidden Roman legacy initiated by Francis Pope, which is now led by Pope Francis and his Jesuit military army. This connection is not coincidental; it marks the beginning of the cat-and-mouse game with the Protestants. The Puritans, escaping from Queen Bloody Mary, fled on the Mayflower to establish a society pure from the Catholic crown's defilement. Queen Bloody Mary earned her nickname for her persecution of Christ's followers, a grim parallel to the "Bloody Mary" drink, which metaphorically represents drinking the blood of saints instead of the blood of Christ.

This Roman influence aimed to claim monopoly, and today, Washington, D.C. stands as the Capital of the United States, embodying this historical legacy. From its inception by Francis Pope to its modern-day leadership under Pope Francis, the UNITED STATES, also known as the DISTRICT OF COLUMBIA or WASHINGTON, DC, reveals a deeply rooted Roman connection. Founded in 1663, Rome, Maryland, and the subsequent 1666 Cestui Que Vie Trust, were pivotal in the papacy's plan to control the global population by the banks issuing fiat slave script called "FEDERAL RESERVE NOTES" or what "We the People" think of as "cash" in America, and majority of countries have the equivelent if they have a central bank. The Jesuit Pope's plan as outlined in the ecumenical counsel is to eliminate the majority of the population in Agenda 21.

— Spiritual Gifts. Volume 1, p. 193-196 “The light that was shed upon the waiting ones penetrated everywhere, and those who had any light in the churches, who had not heard and rejected the three messages, answered to the call, and LEFT the fallen [modern 501c3 SDA worldwide denominational] churches. Many had come to years of accountability since these messages [1844-1848] had been given, and the light shone upon them, and they were privileged to choose life or death. Some chose life, and took their stand with those looking for their Lord, and keeping all his commandments. The third message was to do its work; all were to be tested upon it, and the precious ones were to be CALLED OUT from the [501(c)(3) CORPORATIONS] RELIGIOUS BODIES. A compelling power moves the honest, while the manifestation of the power of God holds in fear and restraint relatives and friends, and they dare not, neither have they power to, hinder those who feel the work of the Spirit of God upon them. The last call is carried even to the poor [DEBT] slaves, [those enslaved by the FEDERAL RESERVE SYSTEM AND THE UNITED STATES CORPORATIONS/commandments and traditions of men] and the pious among them, with humble expressions, pour forth their songs of extravagant joy at the prospect of their happy deliverance, and their masters cannot check them; for a fear and astonishment keep them silent. Mighty miracles are wrought, the sick are healed, and signs and wonders follow the believers. God is in the work, and every saint, fearless of consequences, follows the convictions of his own conscience, and unites with those who are keeping all the commandments of God; and they sound abroad the third message with power. I saw that the third message would close with power and strength far exceeding the midnight cry.”

Rediscovering Rome Before Washington

This exploration into the past reveals an often-overlooked chapter of American history. It uncovers how part of what is now Washington D.C. was once known as Rome, showing a connection between the old world and the new. This narrative not only highlights the forgotten stories of America’s past but also illustrates the rich tapestry of cultural and historical influences that shaped the nation.

American Patriotism and Protestantism in Chains Under the "UNITED STATES" District of Columbia Flag

(This Flag is the flag of the District of Columbia and is Washington, DC, Not More Than 10 Miles Square CORPORATION in NAME ONLY (not land/soil) called: "UNITED STATES")

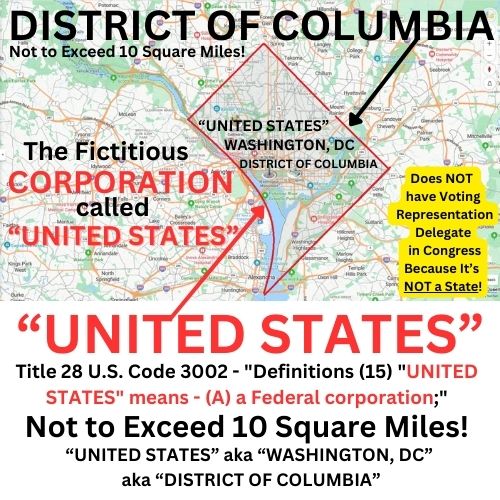

The "DISTRICT OF COLUMBIA" IS the NOT more than ten square miles called the "UNITED STATES" - a Federal Corporation in name only, NOT a STATE, and NOT subject to Congress and is NOT the whole land/soil Americans think of as the united States of America, per Title 28 U.S. Code 3002 - "Definitions (15) "UNITED STATES" means - (A) a Federal corporation;" Open U.S. Code Section 28/3002#15The FEDERAL CORPORATION "UNITED STATES" aka (also known as) the "DISTRICT OF COLUMBIA" aka "WASHINGTON, DC" not to exceed 10-Mile Square Boundary

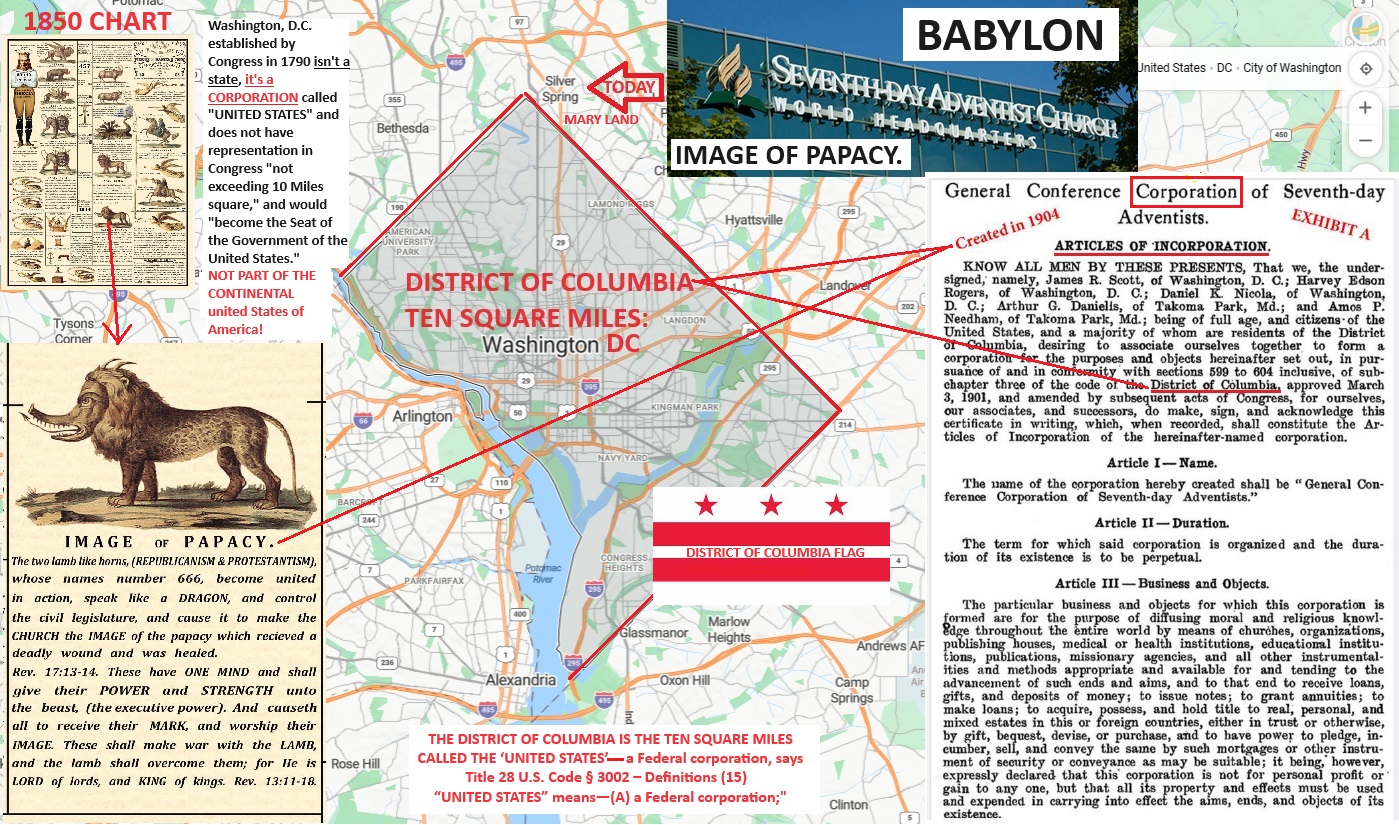

Take a look at this picture and see how the in name only "UNITED STATES" ties in to the where the "new organization" (1SM204) in NAME ONLY (nominal) (not the original Adventist group) General Conference Seventh Day Adventist Corporation STRUCTURE of the "new organization" (1SM204) was formed in 1904 in the "DISTRICT OF COLUMBIA"

not more than ten miles square "Federal Corporation" called "UNITED STATES":"No church can be organized by man's invention [corporate structure in 1904 = "new organization" (1SM204)] but that it becomes Babylon the moment it is organized." Early SDA Protestant Pioneer (One of the 144,000), Elder George Storrs, The Midnight Cry, Februrary 15, 1844, P. 238.

District of Columbia Ten Square Miles and the Image of the Papacy Formed In It in 1904

District of Columbia Ten Square Miles and the Image of the Papacy Formed In It in 1904

District of Columbia Ten Square Miles Where the Image of the Papacy (GCSDA) Arose and Formed in 1904

Relevant Constitutional Clauses

The relevant parts of the U.S. Constitution regarding the District of Columbia's lack of representation in Congress and its size limitation are found in Article I, Section 8, and the 23rd Amendment. Here are the specific excerpts:

Article I, Section 8, Clause 17

This clause gives Congress the power to exercise exclusive legislation over the District of Columbia and specifies the maximum size of the district.

"To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of particular States, and the Acceptance of Congress, become the Seat of the Government of the United States..." The "DISTRICT OF COLUMBIA" IS the not more than ten square miles called the "UNITED STATES" - a Federal Corporation in name only, NOT a STATE, and NOT subject to Congress and is NOT the whole land/soil Americans think of as the united States of America, per Title 28 U.S. Code 3002 - "Definitions (15) "UNITIED STATES" means - (A) a Federal corporation;" Open U.S. Code Section 28/3002#15Read more about Article I, Section 8, Clause 17

23rd Amendment

The 23rd Amendment, ratified in 1961, grants the District of Columbia electors in the Electoral College but does not provide for voting representation in Congress.

"The District constituting the seat of Government of the United States shall appoint in such manner as the Congress may direct: A number of electors of President and Vice President equal to the whole number of Senators and Representatives in Congress to which the District would be entitled if it were a State, but in no event more than the least populous State..."Read more about the 23rd Amendment

Lack of Representation

The Constitution does not explicitly state that the District of Columbia shall lack representation in Congress, but it has been interpreted this way because the NOT more than 10 Square Miles "UNITED STATES" aka "DISTRICT OF COLUMBIA" aka "WASHINGTON, DC" is NOT a state and thus does NOT have VOTING Senators or Representatives. Instead, the District aka "FEDERAL CORPORATION" per Title 28 U.S. Code 3002 in name only "UNITED STATES" (not to exceed more than 10 square miles!) has a NON-VOTING delegate in the House of Representatives.

Learn More and Read Modern Money Mechanics

Creditors and Their Bond Extended

Creditors and Their Bond Extended (pdf)

Creditors and Their Bond Extended (text)

This Roman influence aimed to claim monopoly, and today, Washington, D.C. stands as the Capital of the United States, embodying this historical legacy. From its inception by Francis Pope to its modern-day leadership under Pope Francis, the UNITED STATES, also known as the DISTRICT OF COLUMBIA or WASHINGTON, DC, reveals a deeply rooted Roman connection. Founded in 1663, Rome, Maryland, and the subsequent 1666 Cestui Que Vie Trust, were pivotal in the papacy's plan to control the global population.

“In order for the United States to form an image of the beast, the religious [501(c)3] power must so control the civil government that the authority of the state will also be employed by the church [501(c)3 GENERAL CONFERENCE SEVENTH DAY ADVENTIST] to accomplish her own ends.” The Great Controversy, pp. 443-445

"When Protestantism shall stretch her hand across the gulf to grasp the hand of the Roman power, ... our country shall repudiate every principle of its Constitution as a Protestant and republican government and shall make provision for the propagation of papal falsehoods and delusions." (Testimonies for the Church, vol. 5, p. 451)

This prophecy speaks to the union between former Protestantism and Catholicism in the U.S., leading to the enforcement of Sunday observance, mirroring papal control.

Discover how the Constitution's rights were divinely inspired and why these principles have not been adequately taught to 'We the People.' Get informed quickly here:

The Contitution of the united States (pdf)

The Contitution of the united States (text)

Know Your Constitution - Carl Miller Part 1 of 3:

Know Your Constitution - Carl Miller Part 2 of 3:

Know Your Constitution - Carl Miller Part 3 of 3:

"Our country shall repudiate every principle of its Constitution." The Great Controversy, Ellen G. White.

"There is a principle which is a BAR against all information, which is used as 'PROOF' against all arguments; and which cannot fail to keep man in everlasting ignorance; that principle is condemnation before investigation." Herbert Spencer

Because of the Federal Record of Congress 13 Statutue 223, page 306 Chap. 173, Section 182 [go to/turn to image 306] June 30, 1864: territory; which killed state sovereignty/jurisdiction, affecting 37 states, what STATE really has true, Constitutional jurisdiction? /Case: See 9-10-2015 Houston-Lufkin Tax Division case in PDF here, and link to online case here = DECOPAGE!!! Page 306: Sec . 182. "Word “state” to include “ territories,” and District of Columbia", "And be it further enacted, That wherever the word state is used in this act, it shall be construed to include the territories and the District of Columbia, where such construction is necessary to carry out the provisions of this act. Approved, June 30, 1864."

![Federal Record of Congress 13 Statutue 223, page 306 Chap. 173, Section 182 [go to/turn to image 306] June 30, 1864; Page 306: Sec . 182. -Word -state- to include -territories,- and District of Columbia](/images/Federal-Record-of-Congress-13-Statutue-223,-page-306-Chap.-173,-Section-182-go-to-turn-to-image-306-June-30,-1864.jpg)

"EVERY taxpayer is a Cestui Que Trust [A Cestui Que Trust is a piece of paper and not you a living human with arms and legs] having sufficient interest in preventing abuse of the trust to be recognized in the field of this court's prerogative jurisdiction as relator in the proceedings to set sovereign authority in motion by action" (State of Wisconsin upon the Relation of Harry W. Bolens, Plaintiff in Error, v. James A. Frear, Secretary of State of the State of Wisconsin, Andrew H. Dahl, State Treasurer, et al., 231 U.S. 616 (1913)). Full Citation: State of Wisconsin upon the Relation of Harry W. Bolens, Plaintiff in Error, v. James A. Frear, Secretary of State of the State of Wisconsin, Andrew H. Dahl, State Treasurer, et al., 231 U.S. 616 (1913). Available at: Legal Information Institute. Wisconsin ex rel. Bolens v. Frear, Opinion of the Court. Available at: Wikisource. (Wisconsin ex rel. Bolens v. Frear - Opinion of the Court). This decision highlights the concept that public office is indeed a public trust, emphasizing the fiduciary duty public officials owe to the public. It underscores the legal standing of taxpayers to initiate actions to prevent misuse or abuse of public trust, reinforcing their role as beneficiaries with a vested interest in the proper administration of government duties. When you think about that “EVERY TAX PAYOR IS A CESTUI QUE TRUST” and a Cestui Que Trust is a piece of paper -your social security beneficiary account- then it can’t be a living human being with arms and legs and a living soul (body plus breath equal a living soul)!

Discover the Hidden Truths Behind the Federal Reserve

Unlock the secrets of the Federal Reserve with Thomas D. Schauf's revealing document, "The Federal Reserve Is Privately Owned". This compelling exposé dives deep into the origins, operations, and true ownership of the Federal Reserve, shedding light on facts that are often obscured from the public eye.

Highlights Include:

- The historical background and establishment of the Federal Reserve.

- Detailed analysis of its private ownership and implications for American citizens.

- Insightful revelations about the control and influence exerted by the Federal Reserve over the economy.

Are you ready to uncover the truths that have been hidden in plain sight? Click here to read the full document in PDF format and broaden your understanding of one of the most powerful financial institutions in the world.

“. . . that I should bear witness unto the truth.” — John 18:33

“. . . if the trumpet give an uncertain sound, who shall prepare himself for battle?” — I Corinthians 14:8

Federal Reserve Act - Remedy

Federal Reserve Act Remedy of 1913 and how to apply it today. It’s important to understand why a remedy had to be written into the Federal Reserve Act. Look at what the title says, per the 63rd Congress, Sess. 2; Ch. 4-6, P. 251. “An Act. To provide for the establishment of Federal Reserve banks; to furnish an elastic currency; to afford means of rediscounting commercial paper..” To understand the authority behind remedy in the United States of America, look to the Judiciary Act, of 1789 and read: “...saving to suitors in all cases the right of a common-law remedy, where the common law is competent to give it.” This saving to suitors clause of 1789 allows for the original cognizance by Congress of all seizures on land. Congress was required to write the remedy from elastic currency into Section 16 of the Federal Reserve Act: “They (FRNs) shall be redeemed in gold on demand at the Treasury Department of the United States, or in gold or lawful money at any Federal Reserve bank.”

Section 16 (the remedy from central banking) reveals that Federal Reserve Notes are for reserve banks. Therefore, if you have FRNs in your wallet you are a reserve bank. To restate the remedy: You can stop being a reserve bank by redeeming lawful money in exchange for your Federal Reserve Notes. Corporate powers are defined in the and gold certificates redeemable in gold, to return. (Sandusky Masonic Bulletin March 1933; Mason Museum Colorado Springs, Colorado).

To prevent a bank run, Franklin Delano Roosevelt, formerly Governor of New York State, quickly declared a Bankers Holiday. To make sense of ‘legal tender’ vs. ‘lawful money’ the Constitution for the United States of America speaks of money in two distinct places: “No state shall ... make anything but gold and silver coin a tender in payment of debts” (US Const., 1:10). “To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures.” (US Const., 1:8:5). Considering these two clauses in the context intended by our Founding Fathers, the United States of America should not have a fiat currency and it didn’t have a fiat currency between 1789 and 1861 when an extraordinary emergency occurred, as declared by President Lincoln. (Congressional Globe, July 4, 1861). The emergency that began on March 28, 1861 is still in effect today. Parts of the emergency of 1861 ended in 1976, but per stipulations from Congress at the end of this Act, the Trading With the Enemy Act, and 12 USC 95A, regarding the Bankers Holiday, remain in full force and effect today. Under this same emergency, a Banker Holiday can be called by the Secretary, or the President at any time. (Public Law 94-412; 90 Stat. 1225; Sept. 14, 1976).

Federal Reserve Act, 63rd Congress, Sess. 2; Ch. 4-6, P. 254

“Upon filing of such certificate with the comptroller of the currency as aforesaid, the said Federal Reserve bank shall become a body corporate, and as such, and in the name designated in each organization certificate, shall have power, First. To adopt and use a corporate seal. Second. To have succession for a period of twenty years from its organization, unless it is soon dissolved by and Act of Congress, or unless its franchise becomes forfeited by some violation of law. Third. To make contracts. Fourth. To sue and be sued, complain and defend, in any court of law or equity.”

So, do the math. From 1913 to 1933 was twenty years. All these reserve banks — people with Federal Reserve Notes in their pockets, in their wallets, in their pillows, under their mattresses, in their bank accounts, whatever, wanted to get their Federal Reserve Notes redeemed in 1933 for gold, or gold certificates like United States Notes (USNs) (lawful money); inelastic currency. Since the nature of the FRN is elastic, the Federal Reserve banks had been issuing more notes than they had gold,

This is a critical point to remember in applying the remedy today because they’ve retained the ability to declare a Bankers Holiday in case all of you reserve bankers holding FRNs (private credit) decide to redeem lawful money at the same time; making run on the banks. Bank Holidays are for bank runs, so The remedy is still in place. A year later in 1934, the wording of the declaration was changed to incorporate the gold seized by FDR. Section 16 of the Federal Reserve Act of 1913 was codified into 12 USC 411 and its been there ever since. It was amended in 1933 to read: “[FRNs] shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the City of Washington, District of Columbia, or at any Federal Reserve bank.” Since then, many a patriot has marched into a Federal Reserve Bank with Federal Reserve Notes demanding some sort of lawful money — gold, gold or silver coin, or some sort of substance — according to what the Constitution reads. And now, because of the saving to suitors clause of 1789, Congress cannot take the remedy away. Congress has to leave the remedy in place. So examine the inelastic currency — United States Notes (USNs): “The amount of United States currency notes outstanding and in circulation (1) may not be more than $300,000,000; and (2) may not be held or used for a reserve.” (31 USC 5115). This says that the amount of United States currency notes outstanding in circulation is fixed. The amount of United States notes in circulation cannot be expanded upon through fractional lending. This is the difference between inelastic currency and elastic currency.

For insight into what the courts think about redeeming lawful money, consider what the ninth circuit court has to say. (Milam v. USA, 524 F.2d 629) . . . Although golden eagles, double eagles, and silver dollars were lovely to look at, and delightful to hold, the holder of a $50 Federal Reserve Bank Note, although entitled to redeem his note, was not entitled to do so in precious metal. (Federal Reserve Act, § 16, 12 USC 411; Coinage Act of 1965, § 102, 31 USCA § 392). Here the justices of the ninth circuit admit that this gentleman was entitled to redeem his notes . . . “(a) saving to suitors, in all cases, the right of a common law remedy, where the common law is competent to give it;”

It’s wise for the justices of the ninth circuit not to stand between people and their remedy by law. Sadly we can deduce, by the verbiage, that this gentleman did not know about the emergency, existing since 1861, and about the gold seizure in 1933 (at least he wasn’t acknowledging it in law), whereas the ninth circuit justices know the history of America.

Here’s an informed opinion from the Attorney General of the State of Michigan: “It is my opinion, that the US Const., 1:10 does not require the State of Michigan to pay its debts or receive payment for debts exclusively in either gold or silver coin. It is further my opinion that the State may not require payment of private debts exclusively in either gold or silver coin, since Congress alone possesses and exercises that authority.” (Opinion 5934, July 15, 1981). Therefore, one should pay attention only to how Congress defines lawful money. (US v. Rickman, 638 F.2d 182): Congress has declared that Federal Reserve Notes are legal tender redeemable in lawful money. In a similar case (US v. Ware, 308 F.2d 400): United States notes (USNs) shall be lawful money and a legal tender in payment of all debts, public and private, within the United States except for duties on imports and interest on the public debt.

Attorneys in black robes are trained to give opinions that make it sound as though they have the authority to define lawful money. I just told you the definition by Congress and it’s from this very case. Defendant argues that the Federal Reserve Notes in which he was paid were not lawful money within the meaning of the Constitution at 1:8. We have held to the contrary. We find no validity in the distinction which defendant draws between “lawful money” and “legal tender.” (US v. Ware, 308 F.2d 400, 402-403). Ware endorsed his pay-checks and by doing so he bonded his substance to elastic currency, silently claiming thereby that elastic currency was as good as lawful money to him. Money is a medium of exchange. Legal tender is money which the law requires a creditor to receive in payment of an obligation. The powers granted to Congress by the Constitution include authority over revenue, finance and currency. (Norman v. B & O R Co., 294 US 240; 55 S.Ct. 407; 79 L.Ed. 885). In the exercise of that power Congress has declared that Federal Reserve Notes are legal tender and are redeemable in lawful money. The Defendant received Federal Reserve Notes when he cashed his pay checks and used those notes to pay his personal expenses. He obtained and used lawful money.

This explains the frustration of so many patriots going into the bank with FRNs demanding lawful money in exchange for the FRNs. They walk in admitting that they endorse private credit as being money. FRNs are not lawful money. FRNs are not United States Notes (USNs) which are lawful money. They’re coming in with Federal Reserve Notes, private credit, demanding Federal Reserve Notes lawful money, but they already incurred the tax liability. They’ve already endorsed private credit.

(Milan v. USA, 524 F.2d 629). Because the limit of the exemption on income tax for coinage is only $1,000 dollars, I will only touch upon that lightly. Coins do not say that they are Federal Reserve tokens. They say that they are coins equivalent to US dollars. The following recent asset report from the Federal Reserve to Congress reveals the situation about gold since the late 1970s. Financial ministers around the world, in amending the Bretton Woods agreements, accepted France’s and America’s decision to go from the fixed exchange rate of gold — US dollar domestic to US dollar foreign — to a floating exchange rate called Special Drawing Rights (SDRs). (Statistical Supplement to the Federal Reserve Bulletin, May 2008). “SDR’s are often called “paper gold,” and here we see that the gold in the United States, United Nations, and IMF trust fund, is still earmarked at $42.22 per ounce. This should peak the interest of anybody who has bought and sold gold because spot today is nearly $1,000 per ounce.” Wouldn’t it be nice to find a window where you could buy gold at $42 and sell it at another window at about $1,000. That would crash the windows and the difference between the US dollar and Federal Reserve Note. However, four quarters, divide as equally into US Dollars as they divide into Federal Reserve Notes, but there’s a discrepancy in the value of the coins. Congress has stretched Federal Reserve Notes and United States Notes to the point where, if you were to tender United States notes they would be accepted at the same face value as Federal Reserve Notes, a 20 to 1 discrepancy. Since 1933, when remedy was fresh on people’s minds, and they were threatening bank runs to redeem lawful money in place of Federal Reserve Notes, few people have been redeeming lawful money in United States Notes, so on January 21, 1971, the Treasury stopped putting more USNs into circulation. Nobody was demanding lawful money instead of private credit from the Fed ( FRNs). (Department of the Treasury, Online FAQ). If you endorse private credit from the Fed by endorsing your paycheck without any restrictive or nonendorsement verbiage, you’ve accepted private credit from the Fed instead of lawful money. (Typical Federal Tax Lien).

If you want to own property, you must purchase it. You must buy it. You must pay for it in lawful money instead of private credit that has a residual first lien on the property by whomever you got the private credit from. It’s vital to understand the distinction between discharging a debt and buying something. If you buy something you own it in allodium. Allodium means that you used lawful money to purchase it. If you discharge debt there’s an obligation residing therein. There’s a difference between a debt discharged and a debt paid. When discharged, the debt still exists, although divested of it’s legal obligation during the operation of the discharge. Something of the vitality of the debt continues to exist, which is transferred and the transferee takes it subject to it’s disability to the discharge. (Stanek v. White, 172 Minn. 390, 215 N.W. 784).

Many well intentioned patriots fall into the trap of thinking that a Notice of Federal Tax lien is part of curing the lien. It’s not part of perfecting the lien. It’s notice to third parties that the lien is already cured because the Treasury has the first lien. The law states the remedy simply. “[Federal Reserve Notes] shall be redeemed ... on demand...” (Federal Reserve Act, § 16). That’s all there is to it. A fellow on the Internet endorses with the following verbiage above his signature on the reverse side of a check. And this worked rather well with tellers. They don’t understand it, so they quickly give you your funds in lawful money; United States notes in the form of nonnegotiable Federal Reserve Notes. REDEEMED IN LAWFUL MONEY PURSUANT TO 12 USC 411, John Doe d/b/a JOHN DOE That Congress retains wartime provisions through the Trading with the Enemy Act for a possible Bankers Holiday may not be enough proof to convince you. Read this Juliard v. Greenman, 110 US 421 (the backbone case of the Legal Tender Cases following the war between the States)... ...notes of the United States issued during the War of Rebellion under acts of Congress declaring them to be legal tender in payment of private debts shall be reissued and kept in circulation. Congress has never enacted any legislation to take United States Notes out of circulation.

As said above, 31 USC 5115 defines the inelasticity of United States notes, and in 1982 congress revised that section by changing “United States notes” to “United States currency notes” for consistency in the revised title. Remember, the Constitution grants the power to remove United States notes from circulation only to the Congress, not to the Treasury, but let’s pretend that the Treasury does have the authority. Listen to this wording, carefully: United States notes serve no function that is not already adequately served by Federal Reserve notes. As a result, the Treasury Department stopped issuing United States notes, and none have been placed into circulation since January 21, 1971. (Treasury Dept. Online FAQ). The Treasury has not and cannot remove United States notes from circulation. Elastic FRNs function as inelastic currency United States notes when they’re not endorsed. As hundreds, maybe even thousands, of Americans started redeeming lawful money from their paychecks, Congress raised the frivolous filing penalty from

$500 to $5,000, and issued a Frivolous Positions Memorandum to all IRS agents. The Memorandum itemized various frivolous positions for which the taxpayer could be charged this new $5,000 penalty fine. Items (11) and (12) come close to the redeeming lawful money issue: (11) Federal Reserve Notes are not taxable income when paid [exchanged] to a taxpayer because they are not gold or silver and may not be redeemed for gold or silver. (12) In a transaction using gold and silver coin, the value of the coins is excluded from income for the amount realized in the transaction is the face value of the coins and not their fair market value for purposes of determining taxable...

But neither one of these refers to redeeming lawful money pursuant to 12 USC 411. Summarized at the memorandum end, it says: Returns or submissions that contain positions not listed above, which on their face have no basis for validity in existing law, or which have been deemed frivolous in a published opinion of the United States Tax Court, or other court of competent jurisdiction, may be determined to reflect a desire to delay or impede the administration of Federal tax laws and is thereby subject to the $5,000 penalty. Well, as I’ve shown, 12 USC 411 is the existing law. And the ninth circuit court opinion supports the fact that Federal Reserve Notes may be redeemed at any time in lawful money. In debating with a tax attorney in an Internet chat room, the tax attorney pointed out that an employee agrees to handle Federal Reserves Notes and private credit from the Fed when he fills out the W-4 or the 1099 form. That is the agreement. Our hypothetical employee is a federal reserve bank handling private credit as intended by the 1913 Federal Reserve Act. This is what and who the remedy is provided for. Now our hypothetical employee is on his way home from work, and he drops into his boss’s bank to cash his $500 paycheck. He has the option to redeem lawful money and get out of private reserve banking. We must stop the Federal Reserve before our nation is completely destroyed!

The US Code states that all Federal Reserve Notes can be redeemed at any Federal Reserve Bank for lawful money. This is a fact; per 12 USC 411! It’s not up to the bank teller, the Secretary of the Treasury, or the bank Notary. To demand lawful money by remedy is up to you. You’re the one who makes the choice. However, bank attorneys become concerned when they realize that they cannot fractionally lend on the funds that have been deposited or withdrawn. If an employee is having withholding sent to the IRS during the year, he could get a full refund in lawful money by simply proving that he had been redeeming lawful money all year long. If he showed that refund check to his boss, his boss might discontinue withholding because the IRS had been unlawfully using the interest on all those lawful funds during that year before he got his refund.

“Is it patriotic to continue paying the income tax and continue subjecting oneself to being chattel bonding the money supply if America is shifted over to ‘paper gold’ or Special Drawing Rights?” The questions you just read is from a 1975 State Department bulletin from Undersecretary of the Treasury, Katz. He’s talking about the preamble to the secret Jamaica/Rambouillet Accord between America and France, piggybacked on amendments of the Bretton Woods agreements of 1976. This was when we went over to SDRs (Special Drawing Rights), a basket of currencies between five exemplary nations where endorsing private credit as the only option, prevails.

The CIA offers current and accurate information about the economics of the world. It is not surprising to see China at the top, nearly $400 billion dollars in the black. It is also not surprising to see, among the 200 or so nations listed, that the United States is at the bottom, nearly $800 billion dollars in the red. There are lots of factors to consider, about import and export account deficits, and so forth, but remember, America started SDR’s back in 1975. Looking at China’s information — after keeping its currency tightly linked to the US dollar for years — China revalued its currency in July 2005, by 2.1% against the US dollar and moved to an exchange rate system based on a basket of currencies. (SDRs).

Simply put, if someone tells you that you don’t have the right to redeem lawful money, use 12 USC 411 and § 16 of the Federal Reserve Act. This is your current law remedy. If they say you’re not doing it correctly, simply say, “Then, the burden is on you, to show me how to do it correctly; banks started redeeming lawful money in January 2004.” The American people have shown what they think of the Federal Reserve, by unknowingly endorsing the private credit thereof.

“A false balance is abomination to the LORD: but a just weight is his delight.” — Proverbs 11:1.